The world of finance and investment is constantly evolving, which presents new opportunities for investors to grow their wealth. One particular development in recent years is the tokenization of real-world assets (RWA). This relatively new concept is set to revolutionize the way we invest by creating fractional ownership of high-value assets such as real estate, art, and commodities. In this blog post, we dive deep into what tokenization of real-world assets is, how it works, and what it means for the future of investment.

Tokenization of real world assets

Tokenization is the process of converting an asset into digital tokens that can be traded on a decentralized network using blockchain technology. Real world assets such as real estate, art, commodities, and even cars can be represented as digital tokens.

The concept of tokenization has gained attention because it could make buying and selling real world assets easier. It could also provide a simpler way for multiple owners to share ownership of a property. The potential for easier transactions, especially for smaller ownership stakes, could increase the liquidity of real world assets.

“Taken to full implementation, tokenization of assets has the potential to allow for retail investment in a wider range of asset classes than is currently available to retail investors,” explains attorney David Duncan. “It also has the potential to allow for a reduced regulatory burden, while also providing greater investor protection than currently exists.”

Fractional ownership

Fractional ownership means that multiple investors can own a share of an asset. It is also possible for multiple investors to own a share of a business and share in its profits and losses. This concept creates opportunities for smaller investors to access high-value assets that would otherwise be out of reach for them.

Fractional ownership is what REITs (Real Estate Investment Trusts) are based on. However, it is also possible to own a fraction of an asset without the need for intermediaries such as brokers and realtors. This approach makes it more efficient and cost-effective to trade assets.

An investment revolution?

The tokenization of real-world assets brings more flexibility and opportunities into the traditional investment world. Another important benefit of tokenization is greater liquidity of assets that are otherwise illiquid. Since assets can be traded on the blockchain network, they have the potential to be bought and sold quickly and efficiently in the secondary market, increasing the liquidity of investments.

How to reap real-world benefits

Investors can benefit from tokenization in several ways. First, this method provides fractional ownership of high-value assets that were previously only available to large institutional investors. Second, it creates a more accessible and transparent investment process that allows retail investors to participate in the market. Third, the blockchain technology behind tokenization creates a tamper-proof system that ensures investors have greater visibility of their assets, reducing the risk of fraud and corruption.

A jump over jurisdiction hurdles

In most regions, issuing tokens for real estate ownership may have the same effect as directly owning the real estate. Laws governing real estate transfer and registration necessitate compliance to effect valid ownership changes. Even in jurisdictions where registration is not mandatory, a mere token transfer would be unlikely to hold legal weight. An insufficient adherence to statutory requirements would leave buyers devoid of substantive rights or interests in the property.

Additionally, real estate holdings often involve business entities such as limited companies, or trust structures such as REITs. Acquiring interest in these assets legitimately requires strict adherence to applicable requirements. For instance, in the United States, Limited Liability Companies (LLCs) are prevalent. Ownership interests in an LLC are documented in an operating agreement, and modifying the ownership structure necessitates voting and amending the agreement. Unfortunately, mere token transfers fail to satisfy these prerequisites, which becomes more cumbersome for companies with numerous members and frequent transactions.

Real legal effect

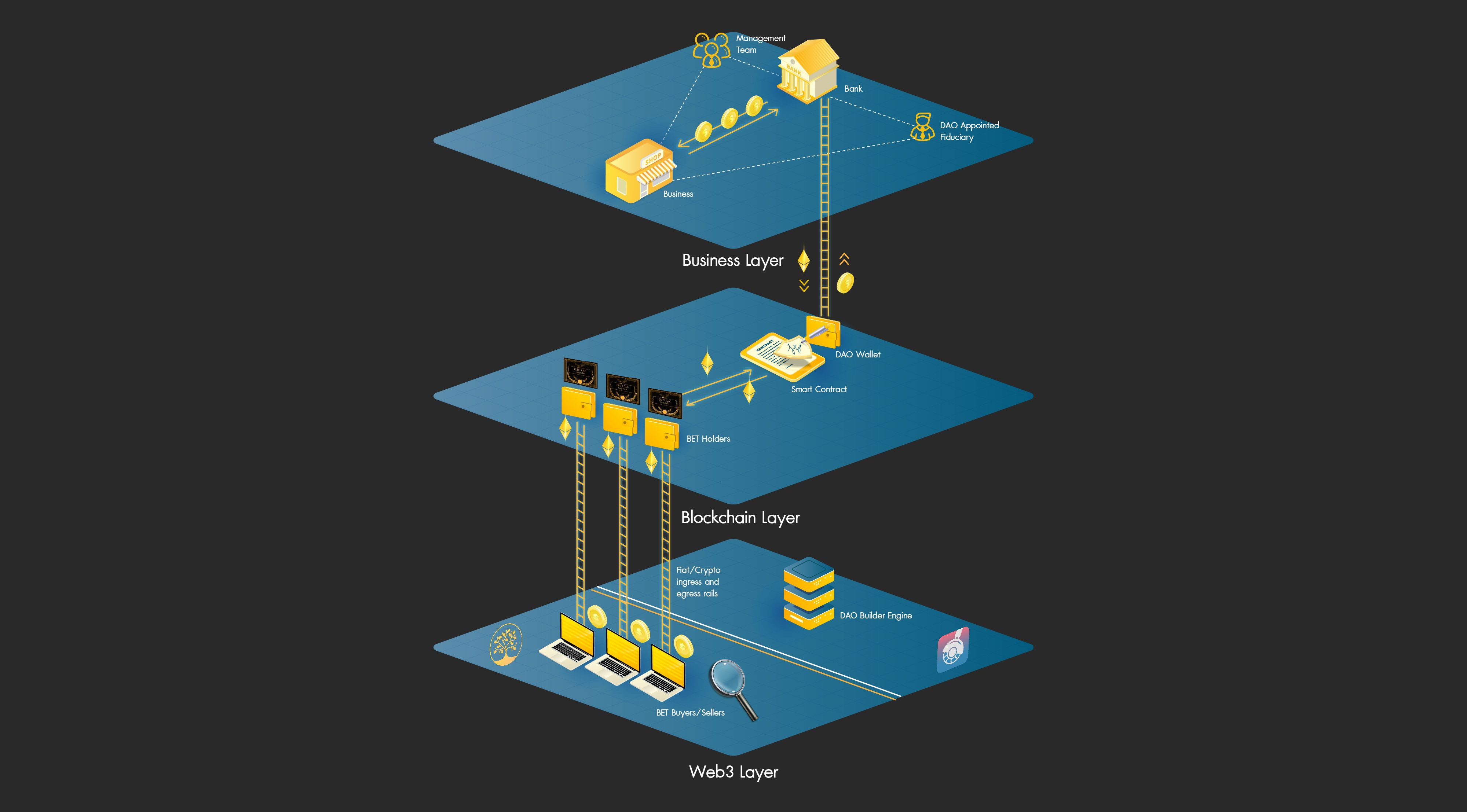

Tokenizing real estate or ownership of business entities requires a legal structure. While most jurisdictions lack such statutes, there are exceptions. One notable example is Wyoming, where the DAO (Decentralized Autonomous Organization) Supplement has established a new type of company called a DAO LLC. These laws recognize a DAO as an LLC and blockchain tokens as membership interests, allowing transfer of ownership through token transfers without the need for paper amendments.

Being recognized as an LLC, a DAO LLC offers limited liability for members, allowing it to operate like a traditional LLC. It can own assets, conduct business, and enjoy transparency and protection through smart contracts. A DAO LLC can even function as a holding company, owning shares in other entities, real estate, and various assets. In this setup, tokens represent ownership in the DAO LLC, which in turn owns the assets.

Wyoming is a state of mind

“Many people have proposed solutions for tokenizing real-world assets, particularly real estate. However, in most cases, the existing legal structure does not accommodate what they have in mind,” adds Mr Duncan. “We particularly like the DAO structure in Wyoming, because that puts an entity and its investors on clear legal footing. Of course, this is a rapidly developing area, and we are keeping an eye on developments in other jurisdictions, too.”

In a world where tokenization is gaining momentum, Wyoming's forward-thinking laws bring us closer to securely tokenizing real estate and business ownership. This opens up a realm of new opportunities for investors to participate in previously inaccessible mainstream investment avenues. Tokenization holds the potential to revolutionize the global economy by democratizing investment opportunities for retail investors, facilitating portfolio diversification. The administrative process is streamlined, cost-effective, and highly secure, thereby fostering trust in the market and increasing trading volume.

Learn more

Learn more