Governance plays a pivotal role in the success of a blockchain network, shaping its direction and ensuring fair and transparent decision-making. This piece outlines the governance model underpinning Haven1, the new Layer 1 blockchain incubated by Yield App which aims to create a secure on-chain environment for retail and institutional participants.

Haven1 leverages the value of identity and validator reputation to ensure that all transactions on the blockchain are secure, with proper recourse mechanisms in place in the event of fraudulent activity. This reputation-based approach allows Haven1 users to interact on-chain without fear of hacks and exploits and in the knowledge that their assets will remain secure at all times.

Haven1’s governance model provides a decentralized mechanism for decision-making on proposals that affect the operation and development of the network. Let’s explore the key features of this governance model, including the role of network validators, the handling of sensitive information, and the process of approving new applications and features.

The role of Haven1’s validators

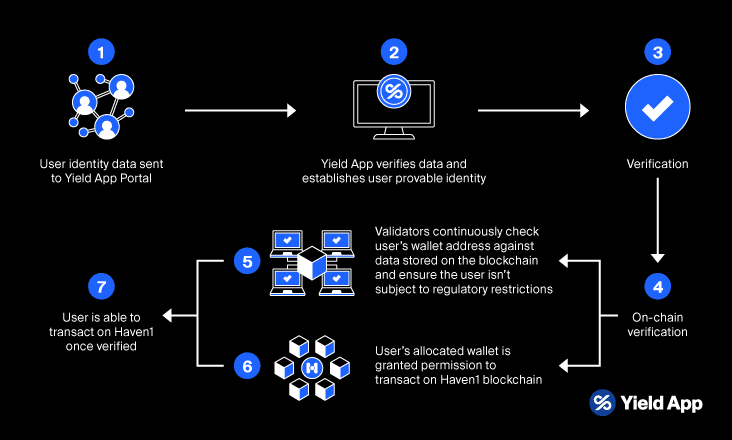

Haven1’s provable identity framework leverages the value of identity and reputation of its block validators. Haven1’s validators will be responsible for maintaining the network's overall security and stability. This involves maintaining an up-to-date version of the blockchain, validating transactions, and ensuring the network is functioning as intended.

These validators will be reputable, public entities, responsible for processing all transactions on the network. They will play a vital role in protecting the network against various types of attacks, such as double-spending attacks, where a user tries to spend the same funds twice.

Haven1’s validators will also be required to checkpoint each user’s wallet address against the anonymized personal data stored on the blockchain to ensure that the user is not subject to sanctions or any other regulatory restrictions. This ensures that only verified users can execute transactions on the network, preventing fraud and other illegal activities. However, by keeping this data anonymous, Haven1 protects the privacy of its users’ data, ensuring that they gain all the benefits of decentralization.

Validator partners

The initial set of validators on Haven1 – the so-called genesis validators or validator partners – are carefully preselected entities. The genesis validators must meet specific criteria to be considered for this role, including being publicly known and well-established with a proven track record of integrity and trustworthiness. This rigorous selection process ensures that Haven1’s validators are reliable, accountable, and can maintain the high operational standards required by the network.

Genesis validators play a critical role in setting the tone for the rest of the network as they are responsible for creating and validating the first blocks on the chain. To ensure transparency, Haven1 allows anyone to verify the identity of its validators and track their performance on the network.

In addition, Haven1 offers incentives to validators who participate in securing its transactions. Each validator will be compensated with a percentage of each transaction fee, subject to governance voting and potential changes over time.

Governance model

Haven1 is designed to establish a secure environment for on-chain finance where users can transact 24/7, just like on any other decentralized network. To achieve this goal, Haven1 employs a decentralized governance model that enables the blockchain’s native H1 token holders to be responsible for the decisions and proposals that affect the operation and development of the blockchain.

All H1 token holders will have the opportunity to engage and participate in the governance of the Haven1 blockchain through a decentralized autonomous organization (DAO) model, whose role is to govern project incentives, protocol upgrades, and treasury funds. The DAO will maintain and advance the blockchain and ensure that all short-term incentives contribute to the long-term vision for Haven1.

The network’s validators play a crucial role in this governance model, as they must ratify all decisions and proposals through complete consensus. By doing so, Haven1 can guarantee that any changes are in line with the blockchain’s goals as well as the interests of its users, and maintain the network’s integrity.

As blockchain technology evolves, Haven1 will facilitate the development of new features and applications via this decentralized proposal mechanism, allowing the network to host new protocols in the future. As outlined above, these proposals will be made by H1 token holders and approved by the validators.

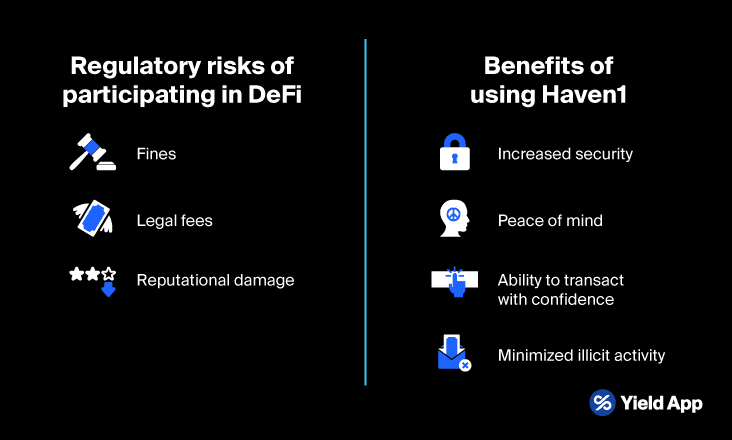

In addition, Haven1 aims to address the uncertainty that is prevalent in the blockchain space due to inconsistent and ever-changing regulatory demands all around the world. Its validators will be required to stay informed on global financial legislation as it evolves, ensuring a secure on-chain environment for all the network’s participants.

Conclusion

Haven1's governance model is designed to provide a secure environment for on-chain finance. With the help of this model and its innovative provable identity framework, Haven1 will keep illegal activity and fraud to a minimum, allowing its users to access all the benefits of decentralized finance in a secure manner for the first time.

The selection of well-established, reputable, and trustworthy entities as genesis validators is crucial to the overall success and security of the blockchain, while the decentralized governance model will ensure that the future of Haven1 remains in the hands of its users. This will allow Haven1 to build a truly unique ecosystem, which prioritizes security without compromising decentralization.

DISCLAIMER: The content of this article does not constitute financial advice and is for informational purposes only. The price of digital assets can go down as well as up, and you may lose all of your capital. Investors should consult a professional advisor before making any investment decisions.

Learn more

Learn more