A DAO is a type of organization controlled by its users instead of a central authority. Rules are written in code and enforced when specific conditions are met.

"DAO" stands for:

Decentralized - It is based on the Blockchain where there is no hierarchy and users share equal power.

Autonomous - Transactions are foolproof and cannot be tampered with.

Organization - It differs from public entities that have directors and executives in that members all have a say in every decision.

Decentralized Autonomous Organizations first appeared in April 2016 when the Ethereum blockchain was launched through a public crowdfunding campaign. In June of that same year, some security loopholes stemming from database errors allowed "The DAO" to be hacked, and $50 million worth of ETH were stolen. As a result, September saw the organization's token get dropped from notable decentralized exchanges.

Other DAOs were later founded, such as:

How Does a DAO Work?

A set of operating rules

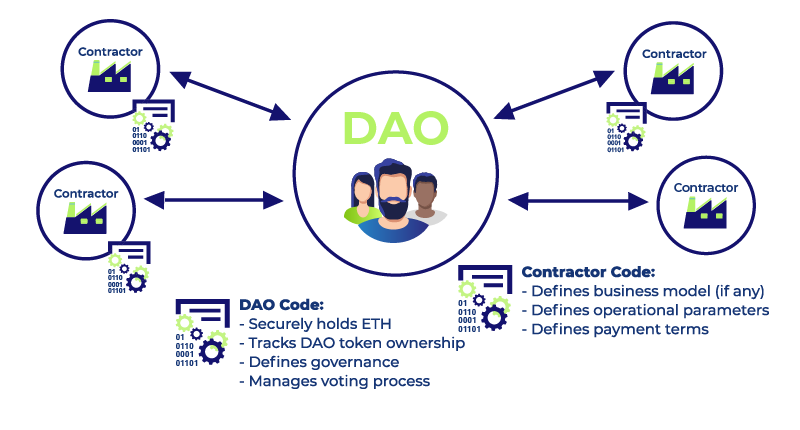

DAOs are encrypted as smart contracts. The rules they set conduct different operations and exist freely on the internet. However, these rules aren't self-sufficient; they still require people to agree to the contracts and carry out a few tasks independently of the program.

The funding phase

With these rules in place, funds are collected from the public. First, tokens need to be generated as a means of exchange or reward. These then grant voting rights to investors, in a a similar way to shareholders.

Once funding is complete, the creators of the DAO "lose" their hold over it, and users start managing it instead. DAOs are designed to be transparent, secure, and resistant to hacks. Transactions and rules are written in the Blockchain, so the open-source code is publicly visible.

The DAO then becomes fully functional. The users' voting rights make them contributors to decisions, in that each person with a stake can make new proposals, which are then put to a vote involving all stakeholders to decide whether or not to adopt them. The percentage that defines the majority rule is always stated in the DAOs code.

What Are The Uses of a DAO?

This business model can be applied to almost every sector. Ethereum's creator, Vitalik Buterin, stated that DAOs would enhance the administration of companies like Dropbox, Amazon, Uber, and Kickstart by eliminating managerial failures.

Sectors that deal with data processing like healthcare, crime, and law enforcement could make great use of DAOs. Cab companies could also serve clients without needing drivers. For now, DAOs serve as efficient tools for token governance, predictions for sports betting, insurance and capital investments. These ongoing projects give us a glimpse of its nearly infinite use cases.

Frequently Asked Questions

What Does DAO Mean?

DAO means Decentralized Autonomous Organization. It's an organization running on an open-source protocol of the Blockchain that works according to the instructions of its participants.

What is The Role of DAO?

It handles risk management.

Its governance is shared and not restricted to specific persons.

It doesn't require legal contracts

It facilitates transactions and governance.

What Are The Benefits of a DAO?

Everyone has a say in the essential operations of the organization. Since there are no management group, decisions are taken collectively.

Members can sell and buy shares directly to one another.

The organization can award dividends to its members.

Many corporate activities are conducted by the algorithm without the need for human intervention. This results in fewer errors, lower transaction costs, and prevents corruption.

What Are The Risks of a DAO?

Cryptographic keys cannot be retrieved, thus anyone that loses theirs forfeits their membership.

Glitches sometime appear in the programming codes of some DAOs, which can cause investment losses and unwarranted liabilities.

A lapse in the smart contract code might not cover certain disputes, and resolution through the traditional legal system may prove impossible.

The algorithm is limited to its programming instructions, so users may have to assess and verify decisions before their execution.

What Are The Protocols of a DAO?

Run by a self-enforcing open-source protocol

Relies on public fundraising

Requires voting consensus on decisions

Members can make proposals

Tokens can be traded

Dividends can be paid to members

What Are The Key Takeaways of DAO?

Not controlled by a central authority

Members jointly decide of its operations

Transactions can be carried out autonomously

Highly secure thanks to its decentralization, but members should store their cryptographic keys in a safe place

Flaws in a DAO's programming can create conflicts

The DAO is an ideal business model that nearly all ventures could well benefit from in time

Do you want to earn market-leading interest rates on your digital assets? Sign up for a YIELD App account today!

DISCLAIMER: The content of this article does not constitute financial advice and is for informational purposes only. The price of digital assets can go down as well as up, and you may lose all of your capital. Investors should consult a professional advisor before making any investment decisions.