Safe lending and borrowing has, until recently, been limited to banks and other traditional financial institutions. When people need a loan, mortgage or credit, they reach out to their bank; and when they want to invest their money, they use that same bank, an adviser, or other conventional financial services. This story has been the status quo for decades and places an enormous amount of trust in these actors to do the right thing.

Decentralized finance (DeFi) doesn’t mean tearing down these existing systems. Rather, much of DeFi imitates and improves upon traditional finance. Many projects aim to provide the same tools as traditional banking, but in a novel way that protects users from interference by fallible intermediaries like banks.

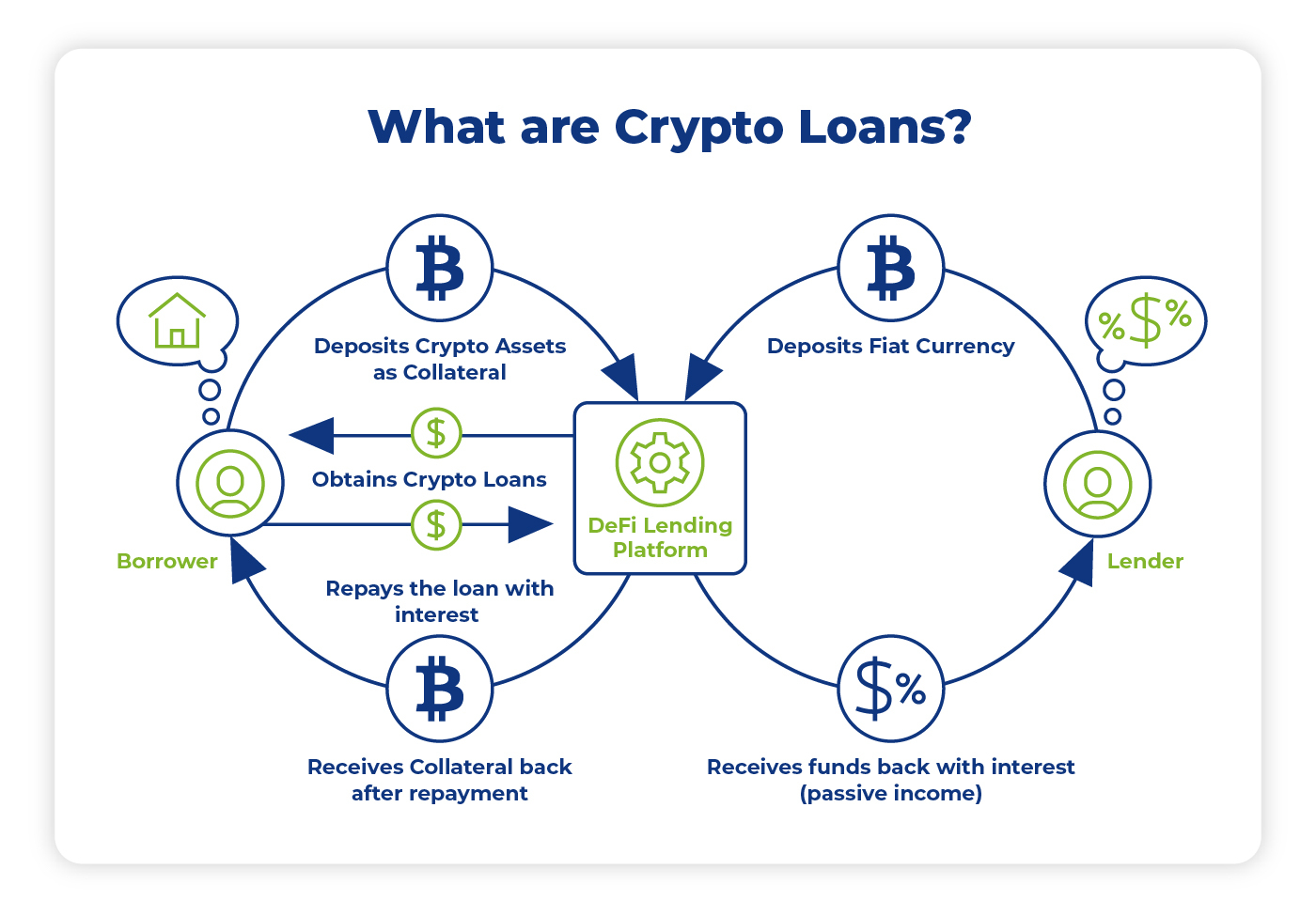

It’s difficult to imagine the global financial system without borrowing and lending, and the same applies to the decentralized financial system. In the past year, DeFi has found creative ways to allow users to borrow and lend crypto assets, successfully creating shared, public, and decentralized lending platforms for the blockchain space. At first glance, decentralized lending and borrowing imitate traditional finance: you can take out a loan, or you can invest your money to earn interest. While the end result looks the same, the means of getting there are very, very different.

New money markets

Decentralized finance is a natural progression of the founding ethos of cryptocurrency first expounded in the Bitcoin white paper: traditional financial institutions are too powerful, centralized, and susceptible to corruption. DeFi is acting on this proposition by building open-source, non-custodial tools for the ecosystem. This paradigm shift has enormous ramifications on the nature of lending and loans: no credit check, personal data, or bank account is required. Everyone can participate. DeFi achieves this using immutable smart contracts that dictate how funds are handled. (If you still feel unfamiliar with how DeFi works, check out our explanation)

Ethereum blockchain protocols like Aave, Compound and Maker have become the most prominent platforms for DeFi lending. Each one allows users to lock their funds in the platform, but smart contracts govern how they work. No third-party can change the underlying code or contracts. Aave, Compound, and Maker are lending services with a proven track record as reliable and secure platforms with easy-to-use websites for executing these complex transactions. As of today, the total value locked (TVL) in these three lending protocols exceeds $6 billion.

When users decide to lend or borrow cryptocurrencies, they sign a smart contract that establishes the interest rate, how much they will supply or request, and when the contract expires. The terms of the contract, of course, cannot be changed, and if a user does want to make adjustments, they have to “complete” the previous contract (either by paying back the loan or reclaiming their funds) and submit a new one.

The relationship between DeFi borrowers and lenders is pretty straightforward: lenders provide funds to earn interest, and borrowers pay interest to use those funds. Each transaction, on its own, looks a lot like any other loan or investment, but the interplay between the two parties is different. It’s a perpetual, symbiotic relationship in which thousands of parties are constantly borrowing and lending from one another without having to interact directly. As a result, we begin to see independent, decentralized money markets appear.

How DeFi lending works

DeFi lending – in which a user deposits their funds into a protocol – resembles a traditional cash deposit or investment that accrues interest over time. Lenders not only earn interest on their digital assets, but receive a governance token or DAI as an additional incentive: Compound rewards COMP, Aave generates LEND, and Maker issues DAI. For retail users, the 3-5% interest for lending is superior to many banks, but may not be enough to justify the ever-present risk of smart contract exploits. For high-capital investors, hedge funds or institutions, however, these rates appear very attractive, particularly when applied to stablecoins like USDT, USDC or DAI. Lending can also help mitigate the dangers of market volatility, since users passively earn capital without trading.

For the most part, lending rates adjust with each Ethereum block. Price oracles help determine the ideal annual percentage yield (APY), which fluctuates to keep the protocol running safely. When users lend cryptocurrency, they receive platform-specific tokens in return (cTokens for Compound and aTokens for Aave). For example, depositing 1 ETH on Compound nets you 50 cETH tokens. The platforms use these tokens to determine your accrued interest and are necessary to redeem your funds.

How DeFi borrowing works

Most assets locked in a lending platform are not there to merely generate interest. Becoming a lender is the tip of the iceberg, and the real magic happens when we look at the possibilities of what lenders can do. Before getting to that, though, it’s important to understand collateral.

Decentralized protocols require no permission to use. Therefore, its services cannot rely on conventional evaluations like credit score, equity or income to determine a safe loan amount. Instead, lending platforms require borrowers to put up crypto assets as collateral. DeFi loans are always over-collateralized. This means that users can only receive a portion of what they put up as their collateral: If you lend $10,000 in ETH, you can acquire up to $7,500 of DAI or other assets (approximately 75% of your collateral). This may seem counterintuitive at first, but it’s necessary to ensure that every user can pay back their loan; if you can’t pay back what you borrowed, you risk the liquidation of your collateralized assets.

Compound, for example, only offers variable interest rates for loans, while Aave users can select from fixed or variable interest rates. Since variable rates change, they expose borrowers to liquidation if the APY exceeds a certain threshold. These variable-rate loans demand daily diligence and attention. They are, however, frequently lower than fixed-rate loans, depending on the current amount lent and borrowed.

DeFi lending and borrowing combined

Over-collateralization raises a big question: Why would you want to borrow against your own assets for a loan that’s worth less than your collateral? This is simply because many crypto holders don’t want to sell their most treasured assets. By lending their capital, they can unlock liquidity without trading. For example, if someone has $50,000 of ETH but doesn’t want to sell it, he or she can supply it to a lending protocol and borrow up to 75% of that value.

This opens up a world of possibilities: crypto traders can execute margin trading on the open market, acquire a token they don’t own for liquidity mining, or take out a short-term loan for real-world emergencies. All without selling a single asset. Crypto lending can be particularly valuable for hedge funds and institutions that hold crypto as part of their portfolio. They can borrow against their own crypto assets, receive a loan, and move it to traditional financial instruments. These are just a few of the many use cases.

Of course, both lending protocols come with risk. However, DeFi has created a new dynamic for borrowers and lenders, a type of product that would be impossible without cryptocurrencies and blockchain.

Do you want to earn market-leading interest rates on your digital assets? Sign up for a YIELD App account today!

DISCLAIMER: The content of this article does not constitute financial advice and is for informational purposes only. The price of digital assets can go down as well as up, and you may lose all of your capital. Investors should consult a professional advisor before making any investment decisions.